How to modify OLTAS TDS Challan Online? Challan Correction Process in TDS TRACES || How to modify OLTAS TDS Payment Challan Details in TRACES?

“How to modify TDS Payment Challans details online on TRACES without any bank intervention”

FYI, TDS (Tax Deducted at Source) is the monthly payment process for the Individuals or Companies having TAN (Tax Identification Number). We need to fill required details to pay TDS Online like TAN Number, Assessment Year for which the Tax is going to pay, Section etc. We have already explained the Online TDS Payment Procedure on our previous Article. Clink the link below to understand the Full TDS Payment Process Online

2. Login Using Your User ID, Password, TAN and after entering Captcha code just clink on Login

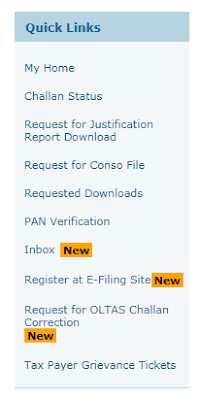

5. Click on the Request for OLTAS Challan Correction

6. A checklist will with some Validations. Accept the Validations by clicking Proceed Button

7. Then There will be 5 Stepped page will appear

8. On 1st Step, it will inform you that you will only able to correct the Following Heads of Challans: Minor Head, Major Head, Financial Year & Section (Challan amount can be modify by the user at the time of Preparation & Filing of TDS Return on Software or on Offline Utility)

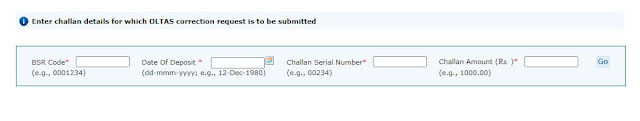

9. On Step 2: It will ask you to enter the detail of that Challan on which you want correction. Just fill the Following Details and Click on Go: BSR Code, Date of Deposit, Challan Serial Number & Challan Amount

10. On 3rd Step: A page will open where on the Top your Challan details will appear & below that it gives you the drop-down sections from where you can fill the correct details

11. After Filling the Required Modification Details, just click on Submit Botton

12. On 4th Step: It Will ask you to confirm the details which you have filled

13. On 5th Step: Just Verify the details by submitting with Authorized Signatory’s Digital Signature

The Modified Challan details will reflect on OLTAS within 3 working days

Earlier we have to write a letter to bank for the Challan Corrections but after the Digitization Process, TRACES (TDS Department) also started the online correction which will going save time & cost of both the Taxpayer & Banker. The NSDL (National Securities Depository Limited) has the rights to correct the Challan. It is the main body of TDS Processing.

Hope you understand the process of Online OLTAS Challan Correction. Do share with your friends so that they can also know about this

Thanks

Team: Online Knowledge Zone

So, if you ever filled wrong details while making TDS Payments, then this article is for you. It may be possible you have filled the Wrong Financial Year, Wrong Section Code, Wrong Section Code, Amount or Wrong Minor Head. You can change all these details online through TRACES Portal (TDS Reconciliation Analysis & Correction Enabling System)

Just Follow the below steps to correct the wrong inputs in TDS OLTAS Challan:

1. First visit TRACES Website’s Deductor Login Page: https://www.tdscpc.gov.in/app/login.xhtml2. Login Using Your User ID, Password, TAN and after entering Captcha code just clink on Login

3. It will redirect you the Dashboard of your TRACES user Profile

4. In the left sidebar, you fill find an option Request for OLTAS Challan Correction (OLTAS is the place where all our TDS Payment Challans Shows after 3 days of the payment) You can check all your TDS Payment Challan details here on OLTAS: https://tin.tin.nsdl.com/oltas/index.html

4. In the left sidebar, you fill find an option Request for OLTAS Challan Correction (OLTAS is the place where all our TDS Payment Challans Shows after 3 days of the payment) You can check all your TDS Payment Challan details here on OLTAS: https://tin.tin.nsdl.com/oltas/index.html

7. Then There will be 5 Stepped page will appear

8. On 1st Step, it will inform you that you will only able to correct the Following Heads of Challans: Minor Head, Major Head, Financial Year & Section (Challan amount can be modify by the user at the time of Preparation & Filing of TDS Return on Software or on Offline Utility)

10. On 3rd Step: A page will open where on the Top your Challan details will appear & below that it gives you the drop-down sections from where you can fill the correct details

11. After Filling the Required Modification Details, just click on Submit Botton

12. On 4th Step: It Will ask you to confirm the details which you have filled

13. On 5th Step: Just Verify the details by submitting with Authorized Signatory’s Digital Signature

The Modified Challan details will reflect on OLTAS within 3 working days

Earlier we have to write a letter to bank for the Challan Corrections but after the Digitization Process, TRACES (TDS Department) also started the online correction which will going save time & cost of both the Taxpayer & Banker. The NSDL (National Securities Depository Limited) has the rights to correct the Challan. It is the main body of TDS Processing.

Hope you understand the process of Online OLTAS Challan Correction. Do share with your friends so that they can also know about this

Thanks

Team: Online Knowledge Zone

Comments

Post a Comment