How to Download Form 26QB from TRACES ? How to Pay TDS under Section 26QB || How to Download Form against TDS Paid on Sale of Property

Whenever we Buy a Property worth Rs. 50 Lakhs or Above, we have to deduct the 1% of TDS (Rate for the Financial Year 2020-21 is 0.75%) from the Payment amount. TDS Always calculated on the Basic Vale of Property before Stamp Duty and other Municipal Charges. Then the Deducted amount needs to be deposited in the Govt.'s account mentioning the PAN Number of the Seller so that they can can claim the TDS credit at the time of ITR Filing. Form 26QB needs to file while making the TDS Payments on the Purchase of Property.

How to Pay TDS under section 26QB (Purchase of Property)?

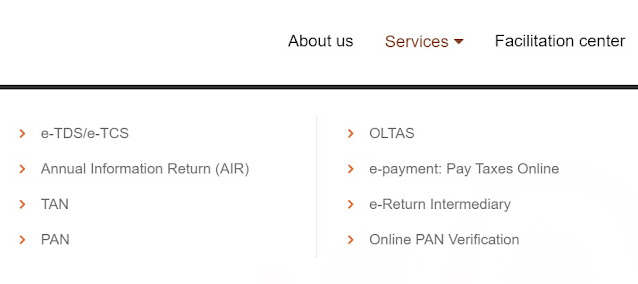

2. Under the Services Menu on The Top go to "e-TDS/TCS Option"

3. Then a page will open. Find there "Pay Taxes Online" Menu and click on "Click to Pay Tax Online"

4. A new Tab will open where we can Pay almost all type of Government Taxes like: TDS, Income Tax, Advance Tax etc. Scroll Down and find "TDS on Property (26QB)" and Click on Proceed

How to Download Form 26QB from TRACES ?

Note: You will not be able to download Form 26QB from TRACES. Form 26QB is only be downloaded from TIN.NSDL Website from where we makes the TDS Payments. People always visit TRACES for all the queries related to TDS. You can download Form 16 and 16A from TRACES but for 26QB, you need to visit TIN.NSDL website to do so.

Process to Download form 26QB from TIN NSDL Website

(a) When you have the Acknowledgement Number of Form 26QB

1. visit TIN.NSDL Website.

2. Under the "Services" menu click on the "TDS on the sale of Property" on the Top Right Corner

3. A new Tab will open where scroll down and go to the Top Down Menu and Click on the "Print Form 26QB"

4. Then again a New Tab Will Open where you need to Fill the PAN of the Buyer, PAN of the Seller, Acknowledgement (Mentioned in the TOP of the Form 26QB when you have make the payments of TDS), Assessment Year on which you make the payment. After Filling above details, just enter the Captcha Code and Proceed.

5. This will Show you the 26QB form details from where you can download the form in just a Click

(b) When you Don't have the Acknowledgement Number of Form 26QB

1. visit TIN.NSDL Website.

2. Under the "Services" menu click on the "TDS on the sale of Property" on the Top Right Corner

3. A new Tab will open where scroll down and go to the Top Down Menu and Click on the "View Acknowledgement Number"

4. Then again a New Tab Will Open where you need to Fill the PAN of the Buyer, PAN of the Seller, Total amount of TDS (You can find this amount in your Books of Accounts or in Bank Statement or from the 26AS of the Seller), Assessment Year on which you make the payment. After Filling above details, just enter the Captcha Code and Proceed.

5. This will Show you the 26QB Acknowledgement Number from where you can Note Down the Acknowledgement Number of Form 26QB

6. Then Again visit TIN.NSDL Website.

7. Under the "Services" menu click on the "TDS on the sale of Property" on the Top Right Corner

8. A new Tab will open where scroll down and go to the Top Down Menu and Click on the "Print Form 26QB"

9. Then again a New Tab Will Open where you need to Fill the PAN of the Buyer, PAN of the Seller, Acknowledgement (Which you have received from the above process), Assessment Year on which you make the payment. After Filling above details, just enter the Captcha Code and Proceed.

10. This will Show you the 26QB form details from where you can download the form in just a Click

Hope you understand the Process

Share with your friends to spread the knowledge

Thank You

Team: Online Knowledge Zone

Comments

Post a Comment