Best Way to invest in Stock Market || How to invest and earn from an IPO? Earn Income in just 7 Days

Stock Market: One of the largest place in India and throughout the world where people invest their amount and earn good profits in short time as well as also invest for the Long Term Profits. Stock Market is the place where you can earn more the the invested amount in just a day. But stock market is the place which is full of risk. The Lack of knowledge can give you the loss which may needs to payback for the entire life also. So, if you are thinking about to invest in Stock market and need a start-up Ides, then this article is for you. Read this full article where we have mentioned the safest method of investment with minimum risk from where you can earn more than 50% of profit in just 7-10 days.

In Short: Stock Market is one of the best investment platform filled with uncertainties & opportunities

The are many methods from were you can invest in Stock market such as:

1. Investment in Shares of Companies (Equity Markets, Future & Options & Currency Market)

2. Investment in Mutual Funds

3. Investment in Golds & Commodities

4. Investment in Bonds etc.

Mutual Funds are long term investments where you need to wait for more than 6 months to earn good returns.

Gold, Commodities and Bonds are also long term investments where we need to wait long to get the desired returns on investments. Also it consist the Physical movement of goods.

Investment in shares needs lots of knowledge because this includes the many technical terms, process, methods & financial know how. But, there are some methods and sources in Stock of Companies available where you can invest in Shares and earn good profit in just 7-10 days.

This method is Called IPO (Initial Public Offer)

What is an IPO?

IPO refers an "Initial Public Offer": When a company needs fund to expend its business or to fulfill it's certain requirement which they are not able to do so because of Lack of fuds, they go towards many Capital Generation options like taking loans rom banks, Issue Debentures, Register in Stock Market etc. Bank Loans and Issuance of Debentures costs lots of Interest Cost which the company needs to pay to the Loan Provider. So, in this case the best methods for the company to divide the shareholding of the company in Small Shares and issue to public against the required funds. To do this, Company organize Initial Public Offer where company makes the small lots of Shares (Bunch of certain share quantities) at fixed issue price

Normally one lot of share consist the minimum amount of 14 thousand Rupees to 15 Thousand Rupees.

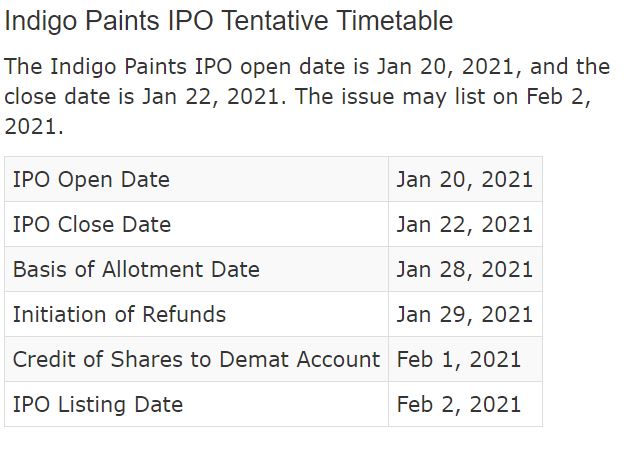

Providing herewith the Example of Indigo paints IPO details for your knowledge:

Once the company decides to enter in Stock Market with an IPO, then they fix the dates to receive the amount (which is called Subscriptions) from the public. Public gets 3 days to subscribe for the IPO's.

IPO Dates includes:

1. IPO Open Date (starting of subscriptions)

2. IPO Closing date (end of subscriptions)

3. Allotment Dates: Where company randomly choose to whom the share will be allotted

4. Refunds: Amount of other applicants who didn't get the share will be refunded in their bank accounts

5. Credit of Shares in Demat Account: Company will transfer allotted shares in Demat account of the subscriber

6. IPO Listing Date: The date when the Shares will be available to Trade/Buy/Sell/transfer in Stock Market

To apply in IPO you need few things which are mandatory. Those are:

1. Demat Account

2. Internet Banking with available funds

That's it! Now you are ready to invest in IPO

How to invest in an IPO?

Please follow the following steps to apply for an IPO through Internet Banking:

1. Open Your Bank's Net Banking Portal. Every bank has the facility to apply for the IPO's through Internet banking

2. Go to Investment Options and Click on Investment in IPO (In some banks you will see the option ASBA instead of IPO, this is the another name for the Investment in IPO) You can click here as well to apply in IPO

3. IPO page will open where you need to select the opened IPO and fill the below mentioned details. (details you provided while applying for the Demat account. These details you can find on the Welcome Letter from the Company from where you you have got the Demat Account Number)

When you open the IPO Page, it may possible there are many IPO's are running that time, select the company's name on which you want to subscribe then fill the following details:

(i) Demat Account Number (16 Digit Numeric Account Number)

(ii) PAN Number

(iii) Date of Birth

(iv) Father's Name

(v) Depository Names (NDSL or CDSL): This can be find on the Welcome Kit received from the Company while opening Demat Account

(vi) Demat Account Provider (Company from where you got the Demat Account)

(vii) Shares Lot Size (Number of shares available in one Lot). This details you can find on the IPO prospectus of the company of you can just check from the following Website: Click Here

(viii) Don't put manual amount in Bid Section. Always click on the cut off price (As check box available there)

(ix) Always apply for just one Lot from one PAN Card.

(x) Different banks may ask for other details also, fill those details carefully and proceed further

4. Once you apply and click proceed, the amount of one lot showing in the IPO details will be freeze in your bank account which you can't use till the IPO allotment date which is maximum 7 days. If you get the IPO (Shares), the amount will be debited from your account and share will be credited in your Demat account. Or if you don't get the shares, the freeze amount will be unfreeze and will be available in your bank account to use as as normal fund. It means you will not going to loose any Rupee. Also, there are no any charges to apply for the IPO. Its free in every bank.

Note:

1. If you have applied for the IPO and later found out that the IPO is not good, then you can withdraw the application during those 3 days (3 Application days of IPO's)

2. IPO application timings are 10 AM to 5 PM and always try to apply before 2 PM on 3rd (last) day of application date

What is the process if you got IPO Allotment/Shares?

If you are lucky among few peoples who applied for the IPO, then congratulations you will going to earn a Profit (with 90% of surety)

Once you get the shares, it will be credited in your Demat Account automatically (Make sure you have mentioned the correct Demat Account Number while applying for the IPO) as mentioned date by the company.

After some days, the Company will list itself on NSE and BSE where now you can sell your shares or Buy further (if want)

When to sell shares received from IPO?

Most of the investors prefer to sell share on the listing day because that days will be the best day when share will be open at their highest levels. You can also maintain the shares for long term as well. But if you are getting good profit on Listing day, then suggesting you to sell the share immediately and book a instant profit

Example: We got the allotment of share of Indigo Paints where we invested Rs. 14,900 (for the lot of 10 shares where one share is equal to 1,490). On the listing day, the share price of a single share reached to 2,600. It means, one share provides me the profit of 1,110 (2,600-1,490). We sold the whole share and earned the profit of 11,100 (for sale of 10 shares)

We earned the profit of 74% in just 10 days. If you can see the current price of Indigo Paints share, which is 2,300 (as on dated 26th March 2021) which is 300 low than the 2,600.

If you have sold the share and later the price increased, then please be patience. Stock Market is the place of uncertainties. You will never know what will happen next. The present value of Profit will be good for us. Don't go for Greed. Satisfy with the profit what you have right now.

So, best strategy for the IPO share is to sell at the listing day (if you thing the Grey Market Premium (Grey Market is explained below) is good to sell on Listing day)

How to withdraw Profit and Invested amount from IPO in Bank Account?

When you sell your shares, the profit and the initial amount will be available in your Demat account which you can easily withdraw through UPI address or through providing bank account details. In most of the cases, if your request for the withdraw, the amount will be automatically transferred to your bank account provided in your previous bank account which you have provided at the time of Opening of Demat Account

What is Grey Market Premium?

In short, the illegal intangible place where the Profit from the Share Prices of IPO estimates by the group of peoples and also operate the buy and sell of shares before the Listing of Shares in Stock Market. Grey Market Price gives you the estimated earnings/Profits (which we call Premium) from particular IPO. The more Grey Market Premium means the more listing gain.

You can check the Grey Market Premium of every IPO Here: Click Here

Precautions and Information everyone should know before applying in IPO of any company?

1. Should check the financials of the Companies like Balance Sheet, Profit & Loss Account, Cash & Bank Balances & Profit/Expense Ratio's etc.

2. If the company is running from continuous loss from the previous some years, then you should avoid that IPO. Example: IPO of Barbeque Nation which is well known but facing losses from past 3 years

3. Company should be famous and operating business actives from past many years

4. Company should not have any changes, legal claims or criminal records in past etc.

5. Check from where the company is generating it's most of the revenue

6. Expenses of Companies (whether its Operating nature or Financing Nature). If the most of the cost consist Financing nature, then ignore the IPO.

7. Competitors, Vendors, Customers and relations with other External and Internal Stakeholders etc.

Why IPO is the beast Option to invest in Stock Market?

Because of the following reasons, IPO considers the best option to start investment in Stock Market instead of directly buying and selling of stocks from Already Listed Shares:

1. IPO Doesn't need deep technical knowledge about Stock Market

2. IPO can be also started by the students who are studying and side by side have interest in study of Indian Stock Market. They can also earn for their Studies and Pocket Money

3. There is no fear of stuck of money. If you got the allotment then profit is yours but if not: then no worry. Exact freezed amount will be refunded in your account within next day of allotment

4. You don't need to track the Stock Movement on daily basis. Just Sell IPO when there is profit just after the Listing and move on

5. No tension of excess amount required for investment. Just consume the profit and use the Principal amount of previous IPO in next IPO (Rotate the amounts)

6. Small Investment-Huge Profits

7. Meet Short Term Goals etc.

Most Important Notes:

(a) Always go through Grey Market Premium amount before investing in any IPO

(b) IPO allotment is pure luck factor. Don't get demotivated if you didn't received any IPO. New IPO's comes every week. Hope for the best and keep applying

Conclusion:

Investment in IPO includes the Risk of Financial Markets. You need to gain more knowledge about investment in Stock Market. So, please do full research and then apply for the IPO's

Hope you like the post and learned something new, then share with your friends and families. Also comment your queries, questions, suggestions and ideas on the comment section below

Thanks & Regards

Team: Online Knowledge Zone

Hi, This is a great article. Loved your efforts on it buddy. Thanks for sharing this with us. what are the pros and cons of paying taxes?

ReplyDeleteI Like to add one more important thing here, Digital Signature Market by Solution (Software and Hardware), Service, Deployment Mode, Application (BFSI, Government & Defense, Legal, Real Estate, HR, Manufacturing & Engineering, Healthcare & Life Sciences), and Region - Global Forecast to 2021-2026- Executive Data Report

ReplyDeleteAt Digital Marketing Thanks for this amazing content.

ReplyDeleteThank you for sharing this information. Keep sharing.

ReplyDeleteE-signature software solutions

Tt

ReplyDeleteTt

ReplyDelete