Extension of AADHAR PAN Linking date || Government extended the PAN AADHAR Linking Date till 30th June 2021

Because of the COVID 19 Pandemic and Website Crash of Income Tax E-Filing, Government of India extended the Due date of Linking of PAN card with AADHAR from 31st March 2021 to 30th June 2021

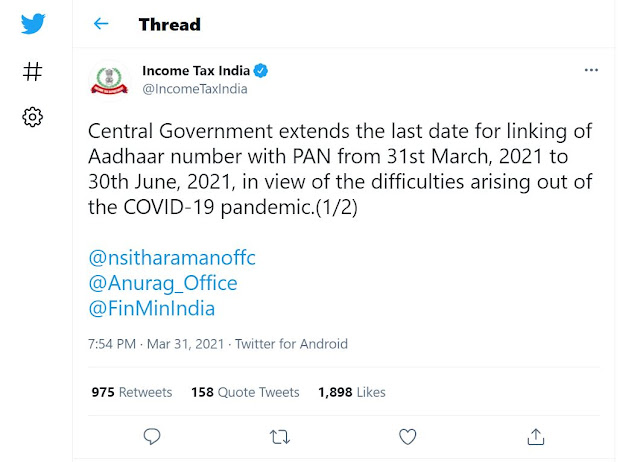

The official twitter handle of Income Tax India has informed through the tweet

Earlier this date was 31st March 2021 but due to the Last date of Income Tax Return Filing for the Financial Year 2019-20 and PAN Linking due Dates on the same day, the Site has been Crashed because of which government took this step to extend the Due date of Linking of PAN card with AADHAR

Fine and Penalties in case of non-linking of PAN with AADHAR:

(1) Government has implemented the Fine of Rs. 1,000 if someone link the PAN with AADHAR after the due date.

(2) The PAN without linked with the AADHAR card will be considered as inoperative and it also lost it's value in many places. Also, the charges of Rs. 1,000 are exclusive of any other penalties. It means this will be the fix charge which you need to pay once you miss the PAN AADHAR Linking Dead Line

(3) Every Bank request for PAN number when you do transaction more than 50,000. When you provide your un-linked PAN then Bank can charge you up to 10,000 of fine for non-compliance of PAN Related activities which is non-linking of PAN with AADHAR

(4) Without linking the PAN with AADHAR, you will not be able to Open Bank Account, File your Income Tax Return etc.

(5) You will be charged Higher rate of TDS than the normal rates

How to Link PAN with AADHAR?

There are numerous methods available through which you can link PAN with AADHAR:

(1) From Income Tax Portal (without Registration): Visit Income Tax Portal > Go to Link AADHAR option in Left Side > Click on that link > a page will open where you need to enter your PAN Number, AADHAR Number, Name as per AADHAR, enter the captcha and Click on Link AADHAR Option

(2) From Income Tax Portal (with Registration): You can also Visit Income Tax Portal > Register yourself as a Individual Resident under Registration Section from Top Right > Fill all the required Details > Once you generate the Login ID and Password then Login in Income Tax Portal > Go to Profile Section > Click on AADHAR PAN Link option > Fill the required details such as PAN, AADHAR, NAME and fill the other details as well > then click on Link AADHAR

(3) From SMS: You can also register your PAN with AADHAR through SMS from the registered mobile number linked with PAN and AADHAR:

Open your message box and click on new message > Enter the following Number (any one) where you need to send the message: 567678 or 56161.Then type in the message box UID space PAN space 12 DIGIT AADHAR NUMBER space 10 DIGIT PAN NUMBER

Example: if your PAN number is AAABC1234D and AADHAR is 1234 5678 9101

Then you need to type UID PAN AAABC1234D 123456789101 and send it to 567678 or 56161 (any one of the number)

(4) Visit AADHAR Centre: You can also link your PAN with AADHAR by visiting AADHAR center or through any Bank by filling required details in a prescribed form

Hope you understand the process of linking of PAN with AADHAR. Share this with your all friends so that they can also link their AADHAR with PAN at the earliest to prevent themselves from loss mentioned above

Thanks & Regards

Team: Online Knowledge Zone

Important Tags #UIDAI, #LinkPANwithAADHAR # NSDL #IncomeTaxIndia #IncomeTaxEFiling #LinkAADHARwithPAN

Comments

Post a Comment