How to Download 26AS from TRACES? How to Check TDS deduction details Online || Check who cuts tax on your income

What is Form 26AS ?

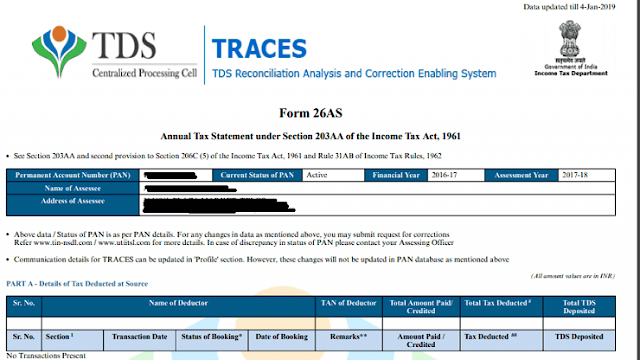

Form 26 AS is the statements which shows the following details:

1. Your PAN Number on the Top

2. Status of PAN (Whether active or not)

3. Financial Year and Assessment Year of 26AS Downloaded

4. Your Name (Business Name)

5. Registered Address on Income Tax Portal

6. Company’ Name Who deducted your TDS

7. Company’s TAN

8. Section of TDS under which TDS was deducted

9. Gross amount paid

10. TDS Deducted and Deposited amount

11. Date of Deduction

12. Date of Booking of Entry in 26AS

13. Form 26AS also shows you the TDS Deducted at the time of Sale of Property

14. Details of TCS (Tax Collected at Source)

15. Refund received against Income tax, Interest Earned on Income Tax Refund & TDS deducted on Interest Received (if any)

16. On Top Below, it shows you the GST Turnover if you have GST Number and filing GST Returns

17. For the convenience of Deductor, it also shows the abbreviations and TDS Sections details for the understanding of the Taxpayer

You can download the form 26AS on your own without any external help from. Downloading procedure of 26AS download starts from Income Tax Portal.

Let’s show you the process to download 26AS from Income Tax Portal:

Process:

Visit Income Tax Website

Login with your PAN number, Password & by entering Captcha Code

Under the my Account Section on the Top, Click on View Form 26AS Tax Credit

A new page will open where it will show you that the site will redirect you to another website to download 26AS. Click on Confirm

Then the site will redirect you to TRACES

Agree the terms and instruction that will appear as a Pop-up on screen

Then on the bottom, click on View Form 26AS Tax Credit

New Page will open. Select Assessment Year for which you want to see the Tax Deducted Details (26AS)

Select View as HTML and Click on View/Download

Click on Export as PDF

Done, open the PDF and check the Tax Deduction Details

Hope you like the post and gained lots of knowledge from this article. Do share with your friends and families so that they can also get the benefit

Thanks

Team: Online Knowledge Zone

Form 26 AS is the statements which shows the following details:

1. Your PAN Number on the Top

2. Status of PAN (Whether active or not)

3. Financial Year and Assessment Year of 26AS Downloaded

4. Your Name (Business Name)

5. Registered Address on Income Tax Portal

6. Company’ Name Who deducted your TDS

7. Company’s TAN

8. Section of TDS under which TDS was deducted

9. Gross amount paid

10. TDS Deducted and Deposited amount

11. Date of Deduction

12. Date of Booking of Entry in 26AS

13. Form 26AS also shows you the TDS Deducted at the time of Sale of Property

14. Details of TCS (Tax Collected at Source)

15. Refund received against Income tax, Interest Earned on Income Tax Refund & TDS deducted on Interest Received (if any)

16. On Top Below, it shows you the GST Turnover if you have GST Number and filing GST Returns

17. For the convenience of Deductor, it also shows the abbreviations and TDS Sections details for the understanding of the Taxpayer

You can download the form 26AS on your own without any external help from. Downloading procedure of 26AS download starts from Income Tax Portal.

Let’s show you the process to download 26AS from Income Tax Portal:

Process:

Visit Income Tax Website

Login with your PAN number, Password & by entering Captcha Code

Under the my Account Section on the Top, Click on View Form 26AS Tax Credit

A new page will open where it will show you that the site will redirect you to another website to download 26AS. Click on Confirm

Then the site will redirect you to TRACES

Agree the terms and instruction that will appear as a Pop-up on screen

Then on the bottom, click on View Form 26AS Tax Credit

New Page will open. Select Assessment Year for which you want to see the Tax Deducted Details (26AS)

Select View as HTML and Click on View/Download

Click on Export as PDF

Done, open the PDF and check the Tax Deduction Details

Hope you like the post and gained lots of knowledge from this article. Do share with your friends and families so that they can also get the benefit

Thanks

Team: Online Knowledge Zone

Comments

Post a Comment